Mutual funds paying high dividends have their own appeal for a certain set of investors, especially those looking for regular income from their investments. Dividend plans distribute profits made by the fund at periodic intervals. Investors who need regular cash flows can benefit from dividend plans and at the same time can grow their capital over investment horizon. Retired investors can consider allocating a portion of their investment to funds with high dividend yield equity funds to supplement their regular income from fixed deposit, monthly income schemes, and beat inflation over a long period of time. Dividend options of equity mutual funds provide investors the opportunity to earn higher post tax income than fixed income investments. Equity fund dividends are entirely tax free, while interest from fixed deposit or monthly income schemes are taxed as per the tax rate of the investor. However, investors should understand the underlying risk return characteristics of equity funds, whether they are growth options or dividend options, are the same. Investors should be very clear about the following points with respect to dividend options of mutual funds.

- Mutual funds cannot and do not assure a certain amount of dividend per unit. Dividends are declared on the basis of the performance of the underlying fund portfolio,

- Mutual funds cannot and do not assure that dividends will be paid at a regular frequency, monthly, quarterly or annual.

- Mutual funds paying high dividends are not necessarily better than funds paying lower dividends.

- Mutual funds paying higher dividends are not necessarily safer than funds paying lower dividends.

- Dividends are paid from the profits of the mutual fund.

- A mutual fund may not declare high dividends just because the underlying portfolio of a fund has given a high return. Dividends are at the discretion of the fund house or the fund manager.

- Dividends are adjusted from the ex dividend Net Asset Value (NAV) of the fund. In other words, the ex dividend NAV is lower by the amount of dividend declared per unit.

How to choose the best dividend paying equity funds?

Total return is the most popular measure of mutual fund performance. It is the total return earned by the investor after factoring in both dividends and capital gains. Consider three different funds:-

- Fund A’s NAV rose from 100 to 120 in one year. It did not pay any dividend during the year.

- Fund B’s NAV rose from 100 to 115 in one year. It also declared a dividend of

र3 per unit. - Fund C’s NAV rose from 100 to 105. It declared a dividend of

र10 per unit.

The total returns of Fund A, B and C are 20%, 18% and 15% respectively. Which fund was best for the investor? It would depend on the investor’s need. If the investor wanted capital gains, then undoubtedly Fund A was the best option, on the other hand if the investor wanted the highest possible income, then Fund C was the best option. For the investor who wants the highest cash-flows from his or her mutual fund investment, total returns are of relatively less significance. Such investors should instead look at metric, known as Dividend Yield.

Dividend Yield

Dividend yield in the stock market parlance is simply the dividend paid by the company divided by the current share price. The dividend yield in the mutual fund context is quite similar. While there is no unified definition of the dividend yield of a mutual fund, the most common definition of a mutual fund yield is the aggregate trailing dividends paid by the scheme over a specified period of time divided by the current NAV annualized over that period.

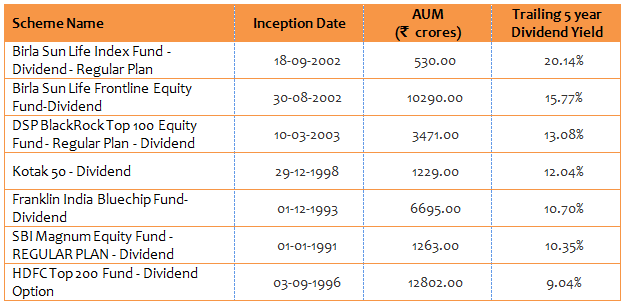

Top Dividend Paying Large Cap Mutual Funds

In this article, we have selected some top paying dividend large cap equity mutual funds, based on the 10 year annual trailing dividend yield. While dividend yields were the most important consideration, we have also looked at other important factors like long term track record of the fund house (AMC), fund performance in terms of total returns, fund size etc.

The table below lists the top 7 dividend paying large cap funds over the last 10 years.

Let us look at the dividend performance of each of these funds individually.

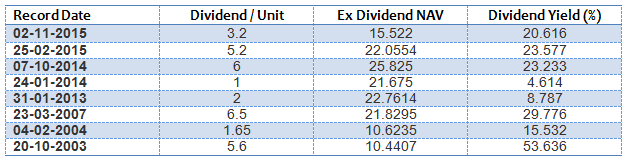

Birla Sun Life Index Fund (Dividend Option)

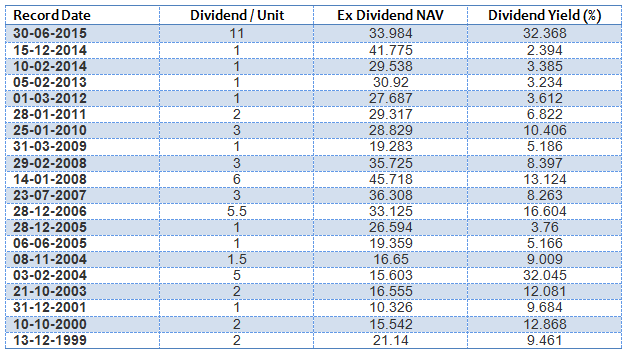

The table below shows the dividends paid by Birla Sun Life Index Fund (Dividend Option).

If you had invested Rs 1 lac in the NFO of the fund, you could have earned dividends of Rs 3.1 lacs, over and above nearly 2 times capital appreciation of your investment.

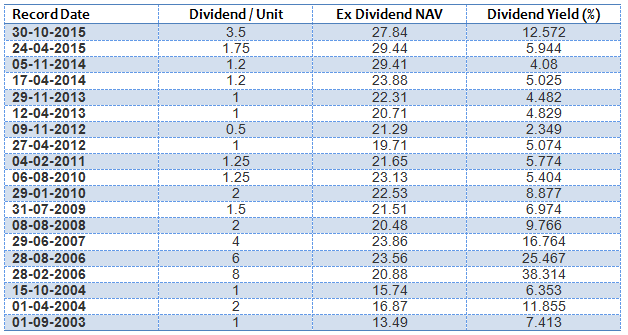

Birla Sun Life Frontline Equity Fund (Dividend Option)

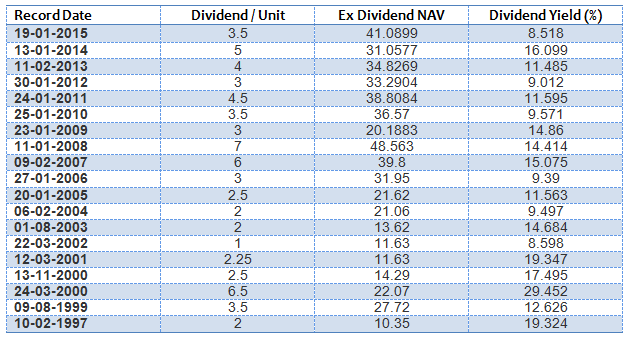

The table below shows the dividends paid by Birla Sun Life Frontline Equity Fund (Dividend Option).

If you had invested Rs 1 lac in the NFO of the scheme, you could have earned dividends of Rs 4.1 lacs, over and above more than 2 times capital appreciation of your investment

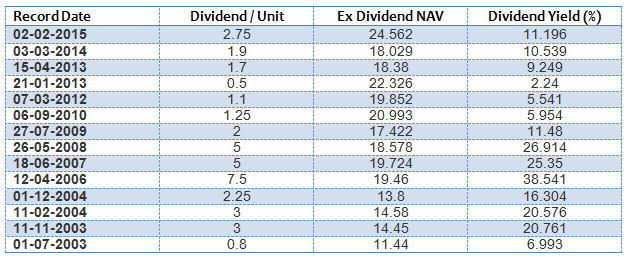

DSP Black Rock Top 100 (Dividend Option)

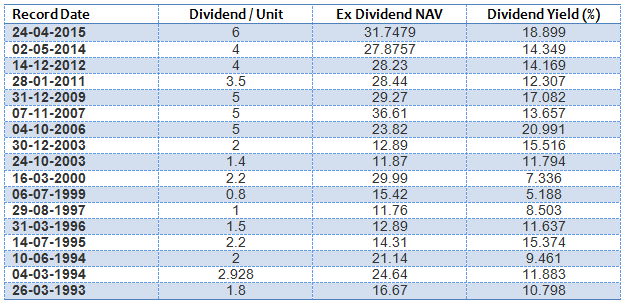

The table below shows the dividends paid by DSP Black Rock Top 100 (Dividend Option)

If you had invested Rs 1 lac in the NFO of the scheme, you could have earned dividends of Rs 3.8 lacs, over and above around 2 times capital appreciation of your investment

Kotak 50 Fund (Dividend Option)

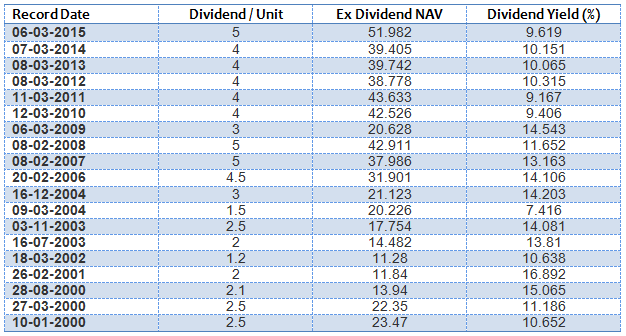

The table below shows the dividends paid by Kotak 50 Fund (Dividend Option) over the last 5 years

If you had invested Rs 1 lac in the NFO of the scheme, you could have earned dividends of Rs 5.4 lacs, over and above around 3 times capital appreciation of your investment

Franklin India Bluechip Fund (Dividend Option)

The table below shows the dividends paid by Franklin India Bluechip Fund (Dividend Option).

If you had invested Rs 1 lac in the NFO of the scheme, you could have earned dividends of Rs 6.7 lacs, over and above around 4 times capital appreciation of your investment.

SBI Magnum Equity Fund (Dividend Option)

The table below shows the dividends paid by SBI Magnum Equity Fund (Dividend Option)

If you had invested Rs 1 lac in the NFO of the scheme, you could have earned dividends of Rs 5 lacs, over and above around 3 times capital appreciation of your investment.

HDFC Top 200 Fund (Dividend Option)

The table below shows the dividends paid by HDFC Top 200 Fund (Dividend Option)

If you had invested Rs 1 lac in the NFO of the scheme, you could have earned dividends of Rs 6.2 lacs, over and above almost 5 times capital appreciation of your investment.

Conclusion

In this blog we have seen that dividends from equity mutual funds can help the investors earn higher income compared to fixed income investments. What is even better is that, while interest from most fixed income investments is taxed as per the income tax rate of the investor, dividends from equity mutual funds is tax free. Choosing the best dividend paying mutual funds is not easy. As discussed, looking at total returns can be misleading, if your objective is to earn the highest income. You should look at the dividend payout track record over a sufficiently long time period. Just because a fund missed out paying dividends in a particular year due to market conditions prevailing during that time, it does not mean that it is not a good dividend payout fund. Trailing dividend yield over a specified time period as described in this blog is a good indicator of the dividend payout track record. However, while dividend yields are important, you should also pay attention to the fundamentals of the fund.